‘Founding Members’ save subscription fee with catch

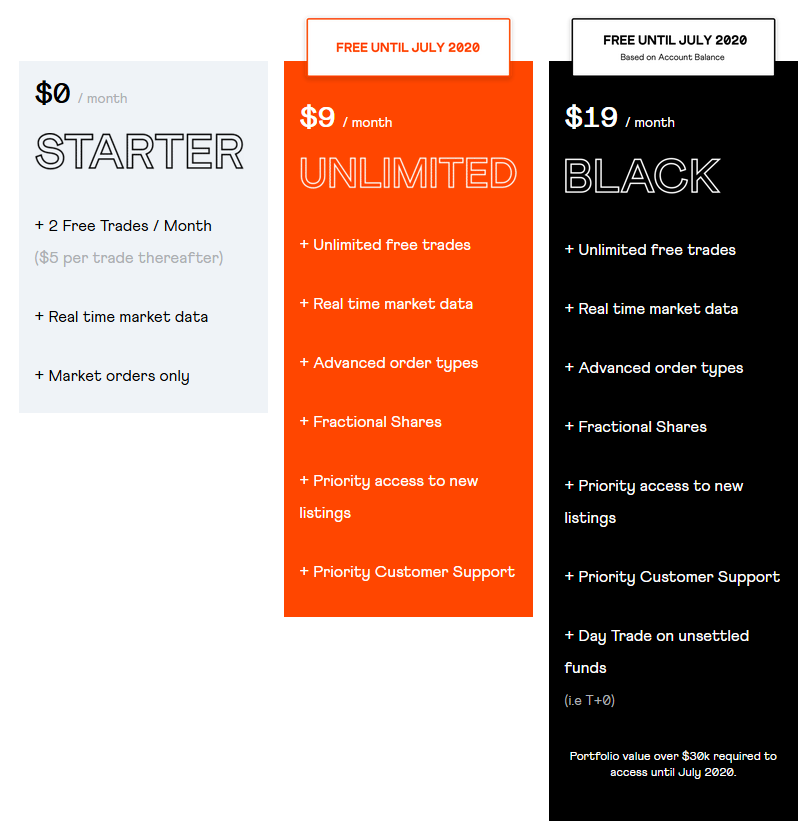

An announcement this week from Stake has given the Unlimited Pack free for life to any Stake customer with a total USD$5K in the platform before March 11. This required value can contain any combination of stock holdings or cash balance in your US Wallet. It does not include any cash in your Macquarie CMA connected to Stake.

While this is a welcome announcement for many investors, some smaller account holders may feel a little left out. In AUD terms this comes out to approximately $7,700 which may be to high for some to reach within a few weeks. Not having to pay for the additional features coming to Stake will be seen as a big win for many. Stake has advised us that a large number of Stake customers are already qualified to receive the ‘founding member’ perk.

Den of Dividends has been in discussions with Stake for some time regarding the proposed change of funding model. While we have suggested some additional ‘perks’ for long time customers, the change announced this week exceeds anything we put forward. Our suggestions mostly looked for access to additional functions or higher limits to any limited functions before additional costs were incurred. To be clear, we had never discussed Stake Unlimited for free to founding customers.

Announcement

Recently we announced some enhancements to Brokerage Packs. Today, we’re announcing a plan to further acknowledge and reward our existing customers – our founding community – in the transition toward this new model.

By 9am on Wednesday 11th March, 2020 all Stake customers who have US$5k or more in their Stake account will receive lifetime access to Stake Unlimited.

That’s right. With a value of US$5k (cash and stocks) and above in your account, you’ll be migrated to the US$9/month Stake Unlimited pack free of charge for life.

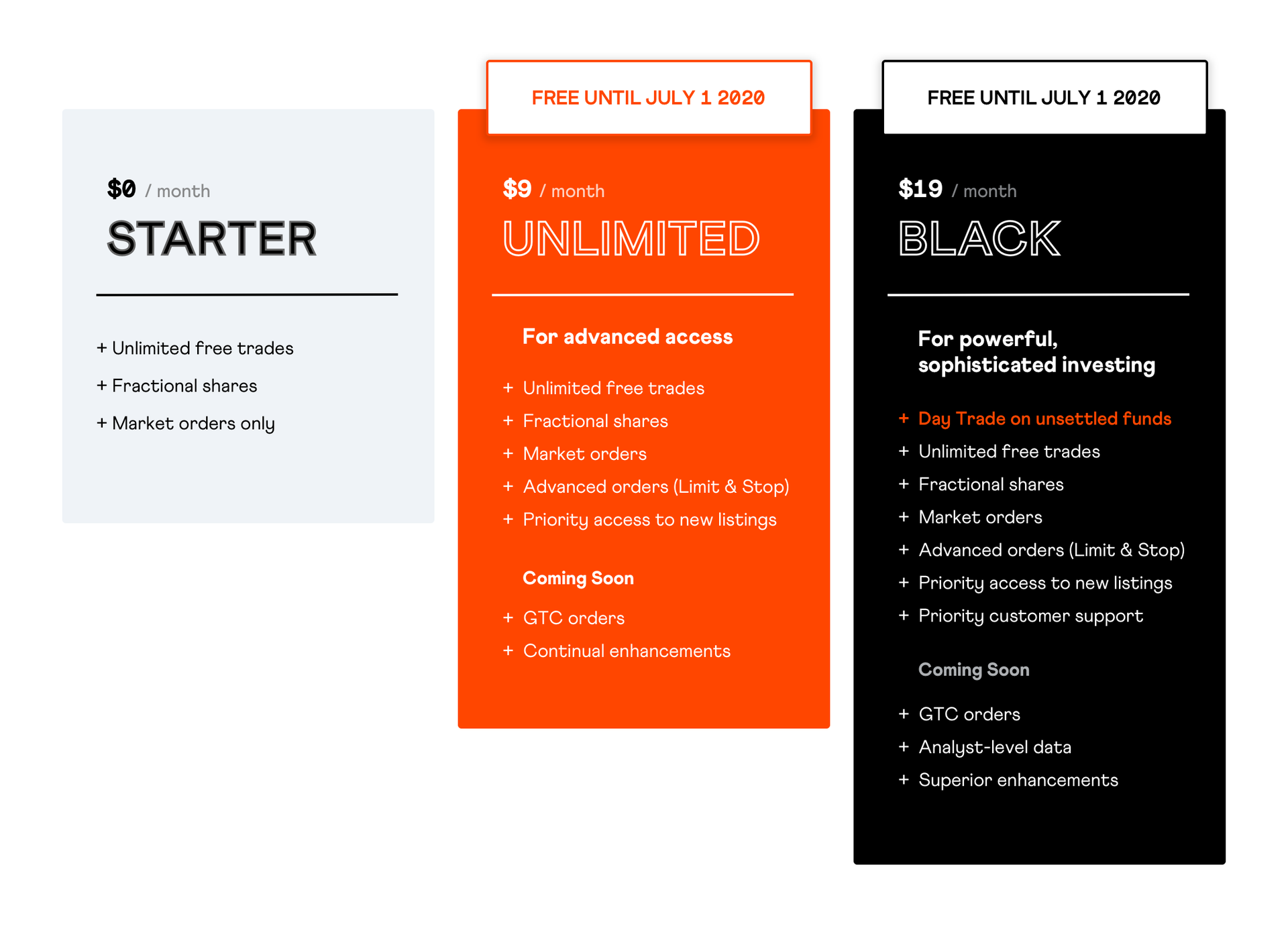

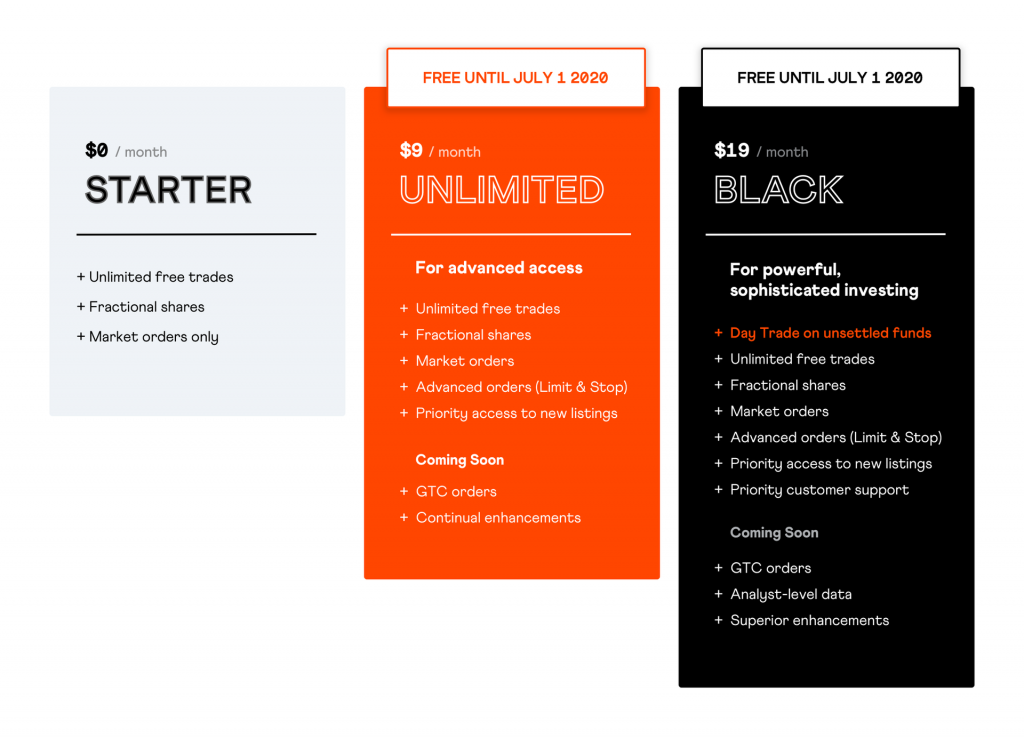

Will I get access to new features added into Stake Unlimited over time?

Absolutely. If you have US$5k or more in your Stake account by the date above, you’ll get all ongoing additions and enhancements as we release them.

What happens if I want to be on Stake Black?

You can. However, this offer extends only to Stake Unlimited, so to access Stake Black you’ll need to pay the monthly fee (after July 1, 2020).

Can I try Stake Black and then move back to my Stake Unlimited access?

Yes. If you’ve taken up the above offer, you can get back onto Stake Unlimited, free of charge, even if you’ve tried Stake Black for a period of time.

What happens if my account drops below US$5k after March 11th?

Nothing. If you have an account value of US$5k or more (cash and stocks) as at 9am on Wednesday 11th March, 2020 you will receive this offer. Once you’ve received this offer, your account balance can change as per normal.

What happens if I have that money in my Macquarie Cash Account?

Only money that is in your Stake USD wallet by the above time and date will count toward the US$5k threshold.

What happens if I already have an account value of US$5k?

You’re in! Just ensure that your account value stays at this level or above until the above time and date and you’ll receive this offer.

We’re excited to be able to reward our community that has been with us from the beginning in this way and we’ll be reminding you on email over the next two weeks to be sure you take advantage.

Click here to read more detail on the Brokerage Packs. Or, if you have any more questions about the above, don’t hesitate to get in touch.

The good …

It is pleasing to the Den of Dividends team that the outcome of Stake Unlimited for free is happening. The original announcement for the new subscription model was badly handled. This should bring most customers onto a ‘better than before’ status.

Additional features that are coming such as the advanced order types like Good til Cancelled (GTC) are helpful. The addition of automated DRP and options trading will make the platform even better.

… the bad

Only investors with the required $5K in holdings/cash on the US-side of the platform will get this benefit. There may be some long-term investors through Stake who have not been able to grow their portfolio to that size. Other customers may have been hit in the global market correction this week, and now have a portfolio below $5K.

If your portfolio in Stake is below $5k and invest with a long-term strategy, Stake Unlimited for free is compelling. We encourage you to fund your account before the deadline to take advantage of this one-time offer. The USD$108 annual fee for the Unlimited Pack will be better spent on further investments in the future. You should not try to stretch your financial position to reach this level.

If you fund your account to try and bring your portfolio up above the $5k requirement, we suggest caution. With markets in a correction then leaving it as cash in your US Wallet until the 12th seems prudent. If you continue to invest and the market falls further you may again be under the required value.

… the ugly

If you cannot afford to fund your Stake account to gain the Stake Unlimited for free benefit, then don’t. Financial prudence is key here, there is no point investing if you do not have emergency funds or it places your budget under pressure. If you only place small trades then you should probably stick with the Starter Pack. The free option is still a best-in-market offer and will likely be for some time.

We continue to ask Stake to provide discounts for annual Unlimited Pack payments up-front. The usual discount rate we see is 20-25% for annual payment. This translates to 2 or 3 months free if you pre-pay. We are also asking for additional payment options like Credit Cards to pay the subscription fees.

… and the workaround

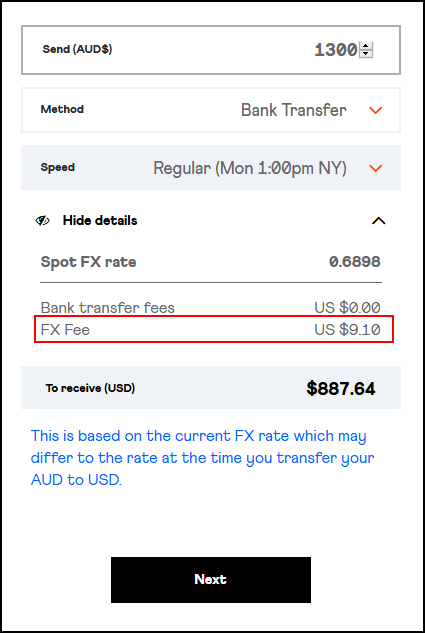

There is also the option of only temporarily funding your account until after the 11th of March. Transfer the cash there now, and then withdraw it afterwards. You will lose FX fees both ways if you use this workaround. For some people this may be a best of both worlds strategy.

UPDATE 2/3/2020: Currently it will take AUD $7800 to meet the funding requirement from scratch at current AUDUSD rate of 0.6540c. You would pay USD $54.60 in FX margin fees to fund the account, and then slightly less while bringing it back. Just doubling the FX fee gives USD $109.20, close enough to the annual cost of Stake Unlimited. If you temporarily fund your account, you can have Stake Unlimited Free from the second year.

Our recommendation

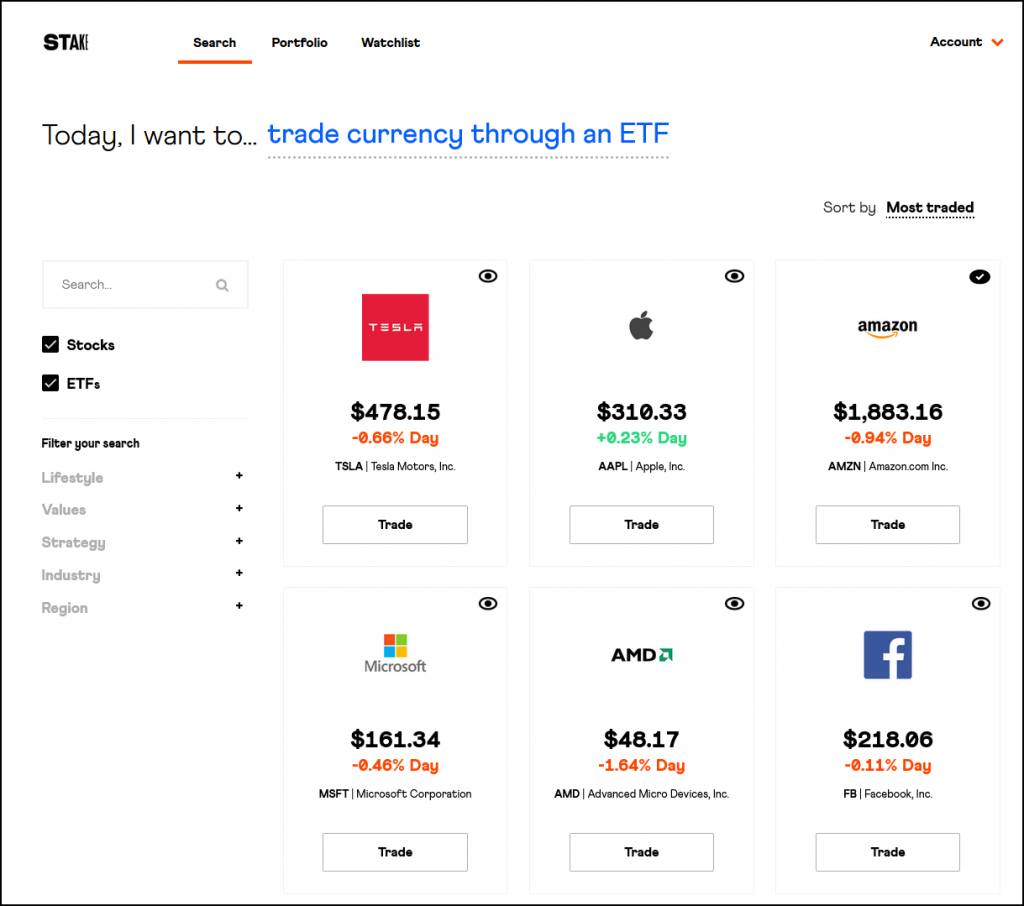

We have been a little reserved in making a recommendation for a broker to access the US markets. We had started with Stake and generally liked what it had to offer. As we were poised to recommend Stake as a good platform, the new brokerage packs were announced. We saw the subscription model as a step backward for existing investors.

What was missing before was providing extra value for the subscription fee, and the impacts to founding members. Those impacts are now resolved for most people. With a commitment to continually adding features to the app and add value over time, we have no further doubts. We believe that Stake is the best platform available for Australian Investors to access the US markets. If you have not already, Sign up with Stake with referral code joeld269 to help us out a little.

Well placed for new competitors

We believe that the offer from Stake will be competitive going forward, even with additional competition expected this year from discount ASX broker, SelfWealth, and UK Fintech provider Revolut. The move by Stake to give Stake Unlimited for free and ‘lock-in’ their existing customer base is a shrewd move and will make it harder for new entrants to get a foothold.

DISCLOSURES:

The author is an active customer (both funding and trading) with Stake, and will qualify for founding member status.

The author has had in-confidence discussions with Stake within the last 28 days.

No payment or inducement has been provided by Stake for this article.

Den Of Dividends has not received nor agreed to any editorial control on this article.