I trusted a platform. I invested through it, understanding the pricing model. That model now changes, and I will pay more and look elsewhere for an alternative because Stake is ignoring existing customers.

Such is the life of a start-up. We are talking about businesses without a proven profitability model, let alone a proven business model. The Fintech industry is one of these disruptors to the Finance industry. The whole concept of being a disruptor in a certain industry is to force change. When that change happens, you need to adjust to the new conditions and your competition.

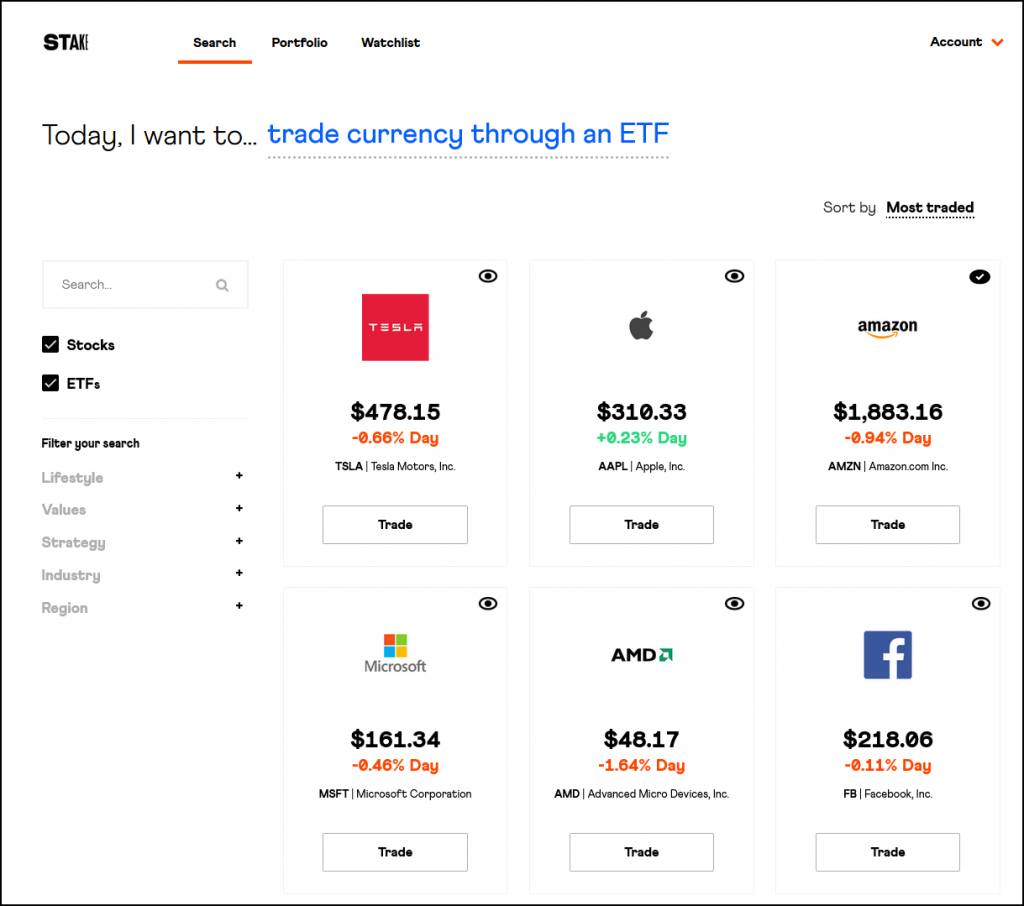

New lower-cost investing opportunities coming online such as the Commsec Pocket ETF app with a $50 minimum transaction value will drive competition for investors cash. US Market broking will see low-cost competition in 2020 from ASX broker SelfWealth, and UK Fintech outfit Revolut who already has digital banking customers in Australia.

A new revenue model with pending competition

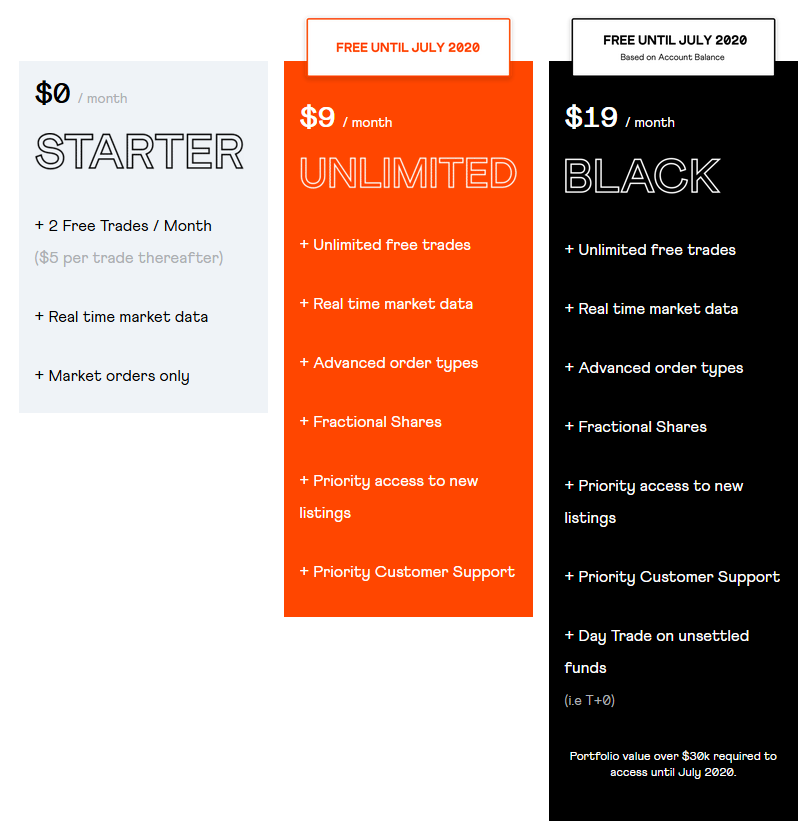

Stake has this week adjusted to the new conditions. After bringing zero-commission trades to Australia, and expansion to New Zealand, UK and Brazil, a lack of cashflow seems to have precipitated this change. They will now only provide two free trades per month, additional trades will be charged at USD$5, and both fractional shares and limit orders will be removed. That is unless you pay a USD$9/month subscription fee.

The existing revenue model for Stake seems to be similar to most other low-cost brokerages. RobinHood and M1 Finance mostly get revenue from Net Interest Margin on uninvested cash in customer accounts. Additionally they sell order flow data to high-frequency trading firms. These firms then ‘bet against’ the order flow being sent to them. Stake have not confirmed or denied order flow data being sold. They do say that they “don’t believe in making our customers the product,” however but the way the app places an order is a little suspect.

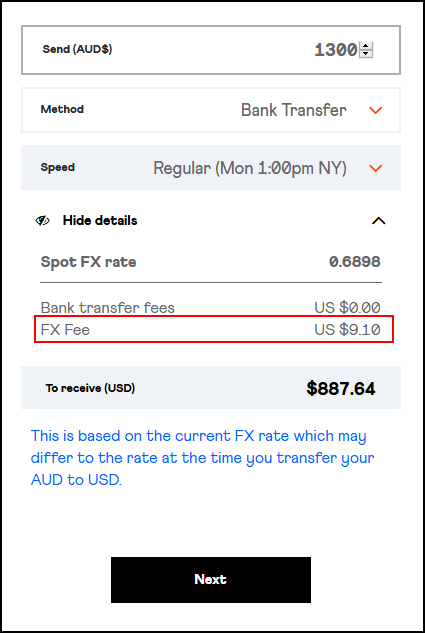

Stake was built on zero-commission trades. They instead charge a margin on Forex rates when their customers fund their USD accounts so they can buy shares. Every AUD$500 attracts a fee of around USD$3.50. The resulting funds in the ‘USD Wallet’ can be used to trade with, with no limitations on the number of trades. There is a USD$10 per trade minimum order value however.

After carefully reading the blog post announcing the changes, and running a few sums, I believe that Stake has misunderstood the way that people invest via ‘apps’ and would not be profitable. With the new $9/mo subscription fee that they clearly want all customers to use, then we can start understanding the issues.

1300 magic number

I found it easy to reverse-engineer the fee within Stake – how much do you need to deposit each month to get to the FX Margin Fee to about USD$9 to match the subscription fee? The ‘Add Funds’ function on the website is very transparent and shows the fees of a proposed transfer.

So with that, the institution of a $9 brokerage subscription fee matches a investors funding at the rate of AUD$1300 per month. I doubt this was the original business plan ARPU figure, but as the company grows and adds developers then costs will increase.

I personally have funded $1300 in a month, and far more than that. Sometimes I fund far less or nothing at all. My goal is to invest into value stocks so sometimes that may be in the Australian Market, or the US market. Stock prices, opportunities and value drive my account funding. Overall in the last 6 months I have funded around USD$16,000 into my stake account.

Most investors would be getting nowhere near that amount of funding per month. I would suggest that most people would max out at approx AUD$500/month worth of funding, and the remainder going into the ASX or savings. This means that revenues for Stake will simply not be enough to survive yet alone grow.

Dividend Reinvestment blues

One issue that Stake may be running into is the cost of trades from customers reinvesting dividends into new shares. This generates no real revenue other than some Net Interest Margin in the USD account. If customers are not funding accounts, then the amount of revenue they can earn will be lower.

An additional complication here is that Stake has promised to reduce the FX Margin fee. No details has come though on this, and we will likely not know the real rate until much closer to July. My own personal opinion is that it should be no more than USD$1 per AUD$1000 however we shall see in time.

Cost of trades

One hint towards the cost structure of the Stake product offer is available from their market clearinghouse partner, DriveWealth. In order to have access to the US Markets and not have to become a full direct partner of the NYSE and NASDAQ, Stake uses a wholesale product from DriveWealth instead. Other Fintech providers also use DriveWealth’s services such as UK Neobank and recent Australian financial services entrant, Revolut.

DriveWealth also provides direct-to-customer broking in the US, and provides the following fee structure for retail clients:

DriveWealth’s default commission structure is a minimum of $2.99 per trade for whole shares and $0.99 per trade for fractional shares. Alternatively, you can opt for the subscription program which makes investing even more affordable. For just $4.99 per month or $14.97 per quarter, you can trade as often as you want for only $0.01 per share with no minimums.*

https://help.drivewealth.com/article/88-what-is-drivewealth-unlimited

For instance, a subscriber would only pay a $0.05 commission to purchase 5 shares of Apple stock, as opposed to the $2.99 that non-subscribers would have paid for the same trade.

From here it becomes easier to see the costs that Stake are incurring, and that the subscription packs they are offering seem to align with the DriveWealth offering. We do need to remember that a wholesale platform cost will likely see around a 30% discount on transaction costs and possibly more on volume breaks.

The remaining revenue from Brokerage packs after paying DriveWealth will be put into building more systems such as the App, paying their developers and other staff, and additional marketing.

Existing customers in the cold

The biggest issue on the customer side is that we feel like we have been duped. Part of the reason why we were okay with the FX Margin was that we did not need to pay any brokerage once we had dividends being paid to our USD account. We could then reinvest these free of any fees.

Additionally, the provided AUD account (a Macquarie Cash Management Account) seems to also be rebating at least some of the interest, with my own account receiving a few cents each month if there was an amount of money in there in the thousands of dollars.

Customers are so important to startups where the cost of customer acquisition is a major reporting metric. Losing customers already gained here would be catastrophic. Gaining new customers will cost more, and competition will raise customer acquisition costs further. Facing serious competition slated to come to market this year, financial financial trouble could be on the cards if there is a customer exodus. Stake ignores existing customers at their peril today.

What should Stake do here?

Luckily, Stake have published a number of comments, including one to the Reddit thread at r/AusFinance where they stated that they will ‘continue evaluating the packs based on feedback from the Stake community’.

Well Stakers – here is what I would do.

1 – Acknowledge customers today

We, your customers, have allowed Stake to be what it is today. We elected to trade with you – many stated they don’t like the product structure and will wait for others in the market. Show us a little appreciation please.

The way to do this is to soften the blow of the changes. This can be done by recognising funded customers prior to this announcement with ‘Founding Customer’ status.

Founding customers should have some benefits over new customers on the Stater/Free pack, and I would suggest that any or all of the following would help:

- 1 or 2 additional free trades per month;

- Allow 1 fractional trade from the free trade allowance (on a set execution schedule and/or chunked like M1 Finance);

- Retain the ability to place good-for-day limit orders only;

- Some sort of discount on at least one additional trade;

- Maintain the USD$10 minimum value trade requirement, with new Starter pack customers seeing an increase to USD$15/$20.

This will allow most existing customers to feel like they have some benefits over new customers. This might stem the flow away from your platform which is already occurring.

2 – What is the new FX Margin?

The promise to drop the FX Margin fees was made, however no details were actually provided. It’s clear you will not drop them anywhere near the required amount to offset most customers monthly fee. This means additional costs for us to trade with you.

Do the right thing and be upfront with us. Tell us what the planned margin is. If it is not final, give us a range you are considering.

Additionally, having an different FX Margin for free level would be a reasonable thing to do here. Maintaining it at the current level may encourage larger investors funding larger amounts onto your subscription plans.

3 – More exchanges, cheaper

It’s quite simple – You should be a full Market Participant of the ASX and NZX. Provide both sides with simple, low cost cross-Tasman consolidated trading for $5 per trade on either side. Far less than current brokers and you have a winner.

After that, lets talk about the UK. The more markets, the more useful you platform becomes. Freetrade are already adding European bourses for their customers with Asia after that. Add the ASX and NZX and we can trade globally for very little.

4 – Improve the Unlimited Pack

There’s a simple question here – what extra value does a $9/month subscription fee give me? Answer on the current pack is very little. If you are not going to deliver new value that customers want, you get this reaction. Additional order types and some new platform features being delivered soon is not enough. Those merely bring you closer to what similar brokerages are delivering overseas.

Here is what the Unlimited Pack should deliver:

- Lower the minimum order value to USD$5;

- Options trading (when available) – L2/Covered calls;

- Dividend reinvestment on a per-stock basis;

- Dividend reporting on portfolio & company basis, including confirmation of payment or DRP stock credited;

- Tax report/statement with correct ATO FX rates on dividends.

These are new or increased value items, and will show us we are getting new features for the additional cost. For example, I could easily cover the cost of Unlimited Pack with the ability to write covered call contracts on two of my stocks.

5 – T+0 not worth $10 per month

I find it interesting that you would grant day trading status to an account for USD$10 per month. Even more so when our accounts have buy orders deducted immediately from our balances. This should be a feature across all paid packs with order value limits. It has minimal risk involved to you.

The only major benefit would be ability to trade on In-Flight funding transfers. That has been a highly-requested feature, but it would kill your express funding fees. I am sure some people would want it, but again you already have the money from our AUD Wallet and it has minimal risk once OFX confirms that FX Order.

Black is simply not worth an additional $10 for that feature. It is an absolute moneygrab which should never have been released without significantly more real value given. Upcoming competitors will beat you on that because they already offer it for less. Instead:

- Throw in a branded debit card attached to the Macquarie Cash Management account;

- Provide Crypto trading access;

- L3/L4 Options access subject to account value minimums;

- Automated investment from deposits similar to M1 Finance.

Remember your two most likely competitors in 2020. Both already have additional features and good customerbases that adding US Market access to will make people jump over to their product because it offers more overall.

The Wrap

We will continue to publish more content on Stake ignoring existing customers, and how the changes progress and get amended over time. Look out for another article outlining the alternatives to Stake and new competitors entering the market.

DISCLOSURE: The author is a customer of Stake and has holdings of NYSE and NASDAQ listed companies within their account at the time of this article being published.