Commonwealth Serum Laboratories (CSL.AX) has now reached hit a price of $336.40. But is it worth the price? Is CSL a buy?

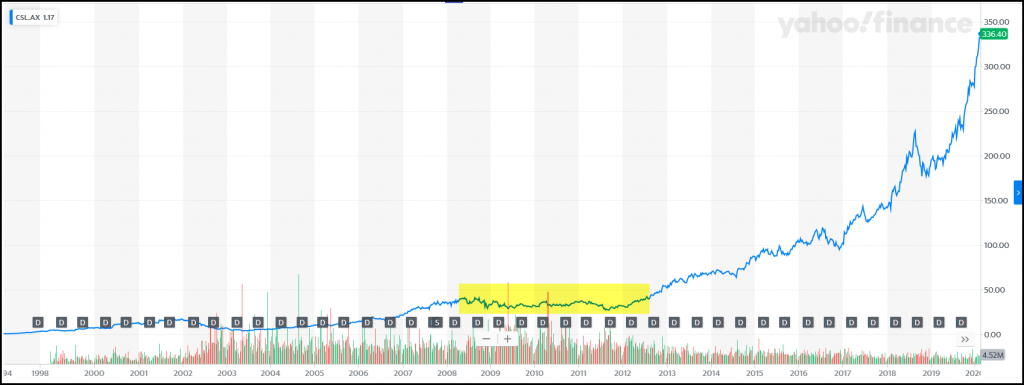

We should consider CSL’s stellar run over the last 10 years. Investors that purchased CSL just after the GFC will have seen 1000% gains. Is a P/E of 50.49x, and a P/S of 12.59x simply too rich of a valuation on CSL? It would be a brave investor to go short against this 10-year chart:

The consistent capital and dividend growth in CSL over the last 10 years make it a unicorn stock. If you invested in 2011 at approximately $30 per share, you now have a ten-bagger stock. Even investors in more recent times have been able to make huge gains. If you purchased CSL in the 2018 correction, you would now only be just short of a 100% gain.

Dividends have also risen over time, with a doubling in dividend paid in the last 6 years. This has no doubt helped the share price rise. But does a 10-year total return averaging 27.5% per annum deserve such a high price?

What is driving CSL higher?

After announcing results recently, an already in-demand stock has gone higher. An 11% rise in Net Profit after Tax (NPAT) seems the most recent cause of CSL shares rising sharply.

At the current time, most of the revenue growth in CSL is being driven by their ‘CSL Behring’ business. Behring is doing well due to global demand for immunoglobulin (IG), otherwise known as Antibodies. These are produced from collected blood products, mostly blood plasma. The plasma is processed to separate out the component products, of which immunoglobulins are just one. These products are then used in medical therapies to treat certain medical conditions.

There are a number of manufacturers of these types of products, however they seem to not be able to expand their capacity. Global demand is rising, and supply is not keeping up. Prices are therefore rising quickly and CSL has been able to expand their capacity to take advantage of this. Higher sales and expanding margins make shareholders very happy. CSL’s two flagship products saw sales growth of 28% and 37% on the previously reported period.

The other CSL businesses have had strong performances also however not quite as well as the IG business. Influenza vaccine sales in their ‘CSL Seqirus’ business were up 16% over the previous period.

These expanding margins which would push any stock higher are being magnified by a weaker AUD. Since most of CSL’s products are sold in USD, higher revenues get magnified when converted to AUD.

Expensive by any measure

Valuation of CSL is difficult by its nature, and lack of direct peers in the market. Some of the competitors overseas are having significant issues in production capacity and specifically in IG products. This is dragging on their results and is a missed opportunity and simply hands market share to CSL. With the current ability to scale, CSL is benefiting from the market demand, higher prices and favourable forex rates to generate profits.

Our valuation metrics show the following numbers for CSL as at ASX close on 21/2/20:

Price: $336.40

P/E: 50.49x

Starting Yield: 0.853%

DCF Valuation: $262.40 (+28.20%)

DDM Valuation: $222.56 (+51.15%)

In this case, the DDM valuation does not provide a significantly useful result due to the high dividend growth of CSL, currently running around 15% an a TTM basis.

What about other valuations?

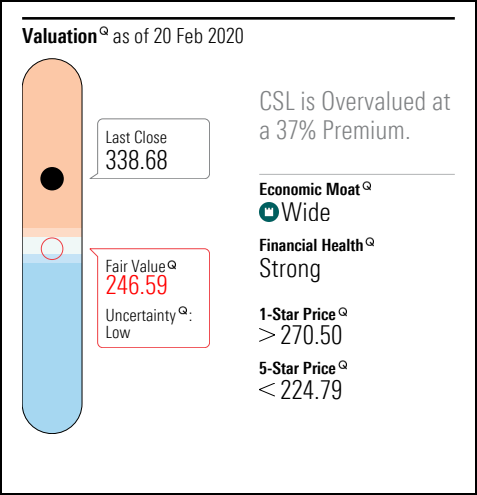

We took a look at other valuations from various data providers. Morningstar is currently valuing CSL at $246.59 as at February 20. They are known to be a little more conservative with their valuations and ‘star ratings’ than some brokers or other analysts. Their figures suggest that CSL is 37.35% overvalued.

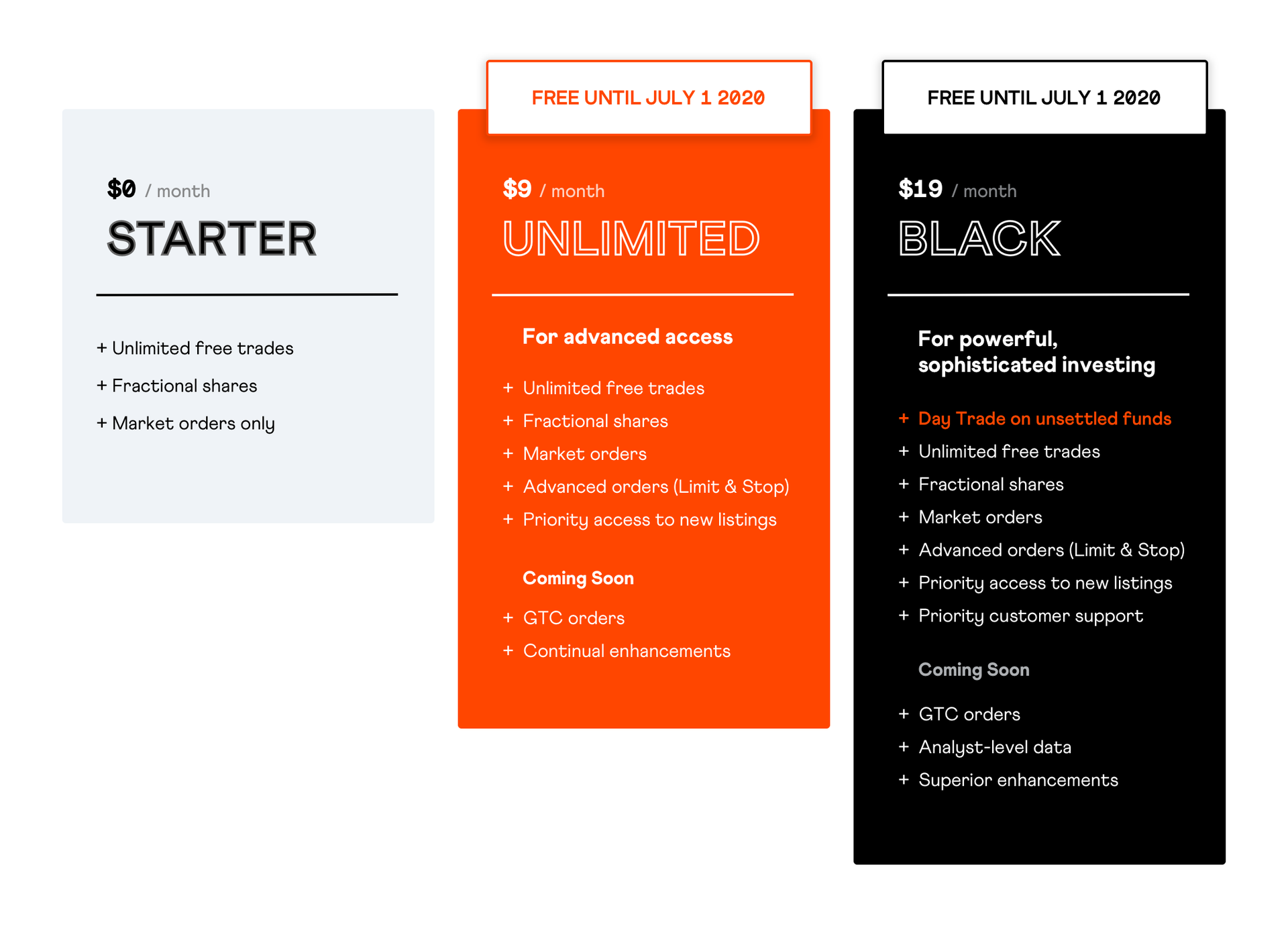

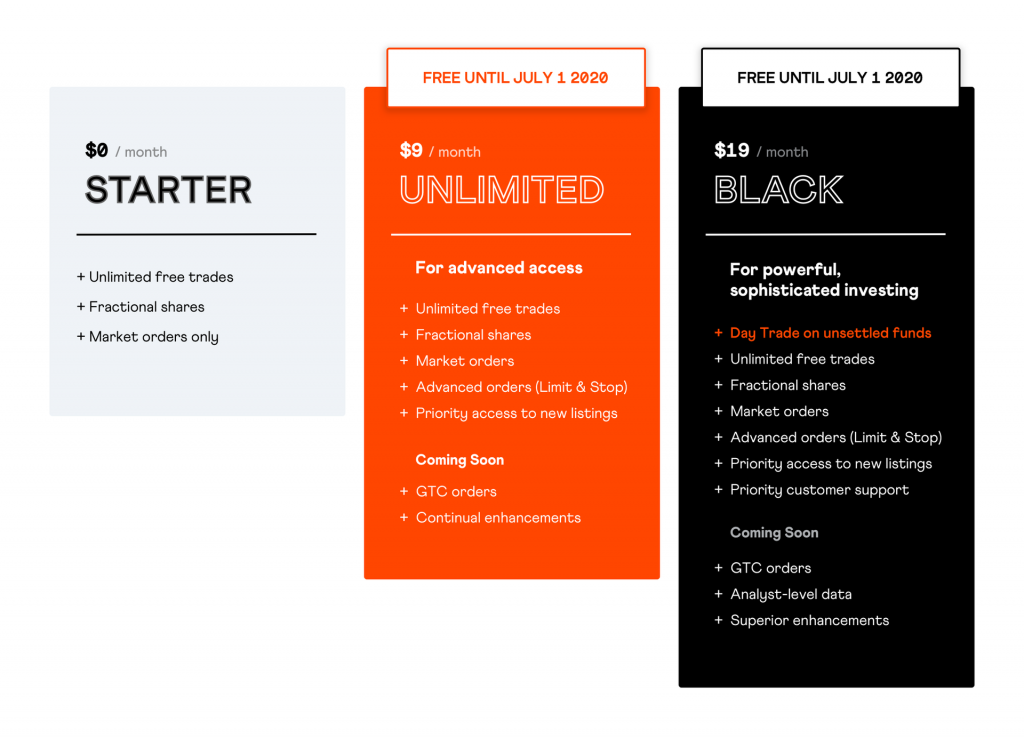

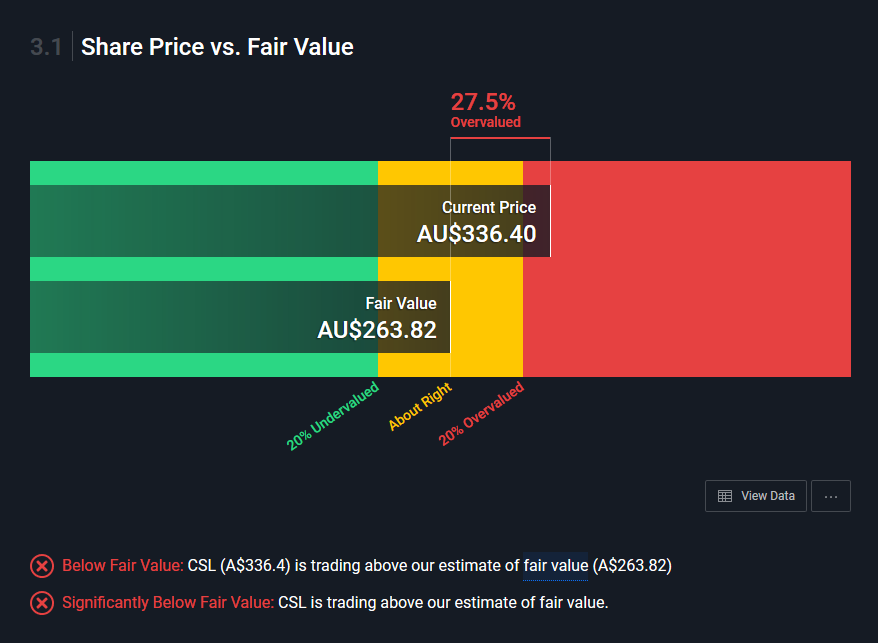

Simply Wall Street also has provided a valuation, which is currently at $263.82 for a 27.5% overvalued rating. We have generally been very impressed with the modelling from Simply Wall Street. The design of the site is excellent, and the information is easy to read and understand.

Forex risks coming

The bulk of CSL’s revenues being denominated in US Dollars. Part of the performance since 2011 is the AUD weakening against the Greenback. In 2008 the GFC raged, the Aussie went beyond parity with the US Dollar, buying over $1.10 at one point.

The end result for investors is a drop in revenue in AUD terms when the AUD rises. In 2008 as the AUD rose, we saw the dividend cut to compensate for the USD weakness. The share price also didn’t do very well in this period.

With the AUD crashing to the 66c mark this week, recent gains may be due to currency fluctuations. The CSL share price will likely come under pressure in the near term if the AUD rises again. A number of economists have put the fair value of the Aussie at around 70 cents. This implies a six percent downside on currency, but that is not borne out by the recent share price action.

Debt ratios are a concern

One of the major concerns is the level of debt currently on CSL’s balance sheet. While debt is not always a bad thing, the amount needs to be controlled. CSL is a capital intensive business and with that comes a need for debt. Total debt/equity ratio is over 92%. CSL is definitely on the higher side of where we would like it to be.

While the dividend payout ratio is low at just over 44%, the concern is that if the AUD strengthens then the revenues will be lower. This puts the payout ratio under pressure, and reduces cash to pay down some of that debt. With a chart that looks more like Tesla the the debt levels raise questions on how CSL will react in a market pullback.

Where is the value?

To get value, I would like to see CSL pull back a significant amount. A drop of around 15% would give a share price of around $285. With a 18% drop it would be priced around $277. Below that I would slowly accumulate wherever I could. CSL would then be back to trend and the market premium on the stock insignificant.

While I am not a technical chartist, it looks like a retracement back towards the trend may be possible. The September 2018 retracement took the stock right back the long-term rising trend. It would appear continuing that long-term trend would put CSL close around the valuation we come up with. I note that the resistance at $285 and support at around $277 between late November 2019 and January this year. Any breach of that $277 support level may present a useful buying opportunity.

My view is that it will take something like an external market shock or general correction for this to happen. CSL is experiencing strong company fundamentals and is slaying their competition with the AUD giving them an additional boost.

Definitely worth waiting

Is CSL a buy? As one of the highest quality companies on the ASX, it always is a company to buy. That said, even the average investor would say that the premium is excessive now. Save your money and get ready to strike if the share price comes back down.

For dividend investors this is not the stock you are after to meet your income goals. It is however an excellent capital growth stock and would not be out of place in any ASX stock portfolio. Just as capital appreciation investors should not ignore all dividend stocks, dividend growth investors should not ignore capital growth stocks. While CSL is clearly both, it most certainly is leaning to the capital growth side in recent times.

DISCLOSURE: At the time of writing, the author held no positions in CSL (aka CSL.AX, CSLLY), and does not plan to trade on this stock within the next 7 days.