After just over two years of providing zero-commission trades in the US market, Australian Fintech operation Stake (‘HelloStake’) has announced changes. The bomb dropped this week on their customers based in Australia, New Zealand, the UK and Brazil amongst others. The threat? Pay up, or lose the features you have.

Stake was launched in 2017 with the aim of providing cheaper and simplified US Market access for Australian investors. The business i funded by Forex margin on AUD/USD transfers, and skimming interest earned on cash balances. While not confirmed, Order Flow information is likely sold to high-frequency trading firms to buy against the orders from Stake. This happens with most brokers providing zero-commission trades for another source of revenue.

In a country where Stake’s competitors spruik themselves as ‘coming to Australia soon’ and have 90,000+ people signed up on a waitlist with no launch in sight, the local start-up has a small yet loyal following.

Subscription model for brokerage announced

The news dropped at 8am last Thursday morning (January 9th, 2020) in an email sent to all customers by Stake CEO, Matt Leibowitz. A blog post on the Stake website was also published with some additional details. This announcement confirmed that zero-commission trades were being withdrawn and replaced with a subscription-based model instead. The spin? Stake will be Introducing Brokerage Packs.

The announced changes are detrimental to existing customers. For those who have already paid the FX margin fees to fund their accounts in the US, you will incur further costs to trade. Additionally the featured being added are minor at best and could not be considered as a major feature. Community requests such as options trading, or new markets have not been promised at this time.

The major changes to the existing zero-commission trades offer are:

- An undertaking to reduce the FX margin on transfers between AUD and USD funds (however no specifics on this was announced);

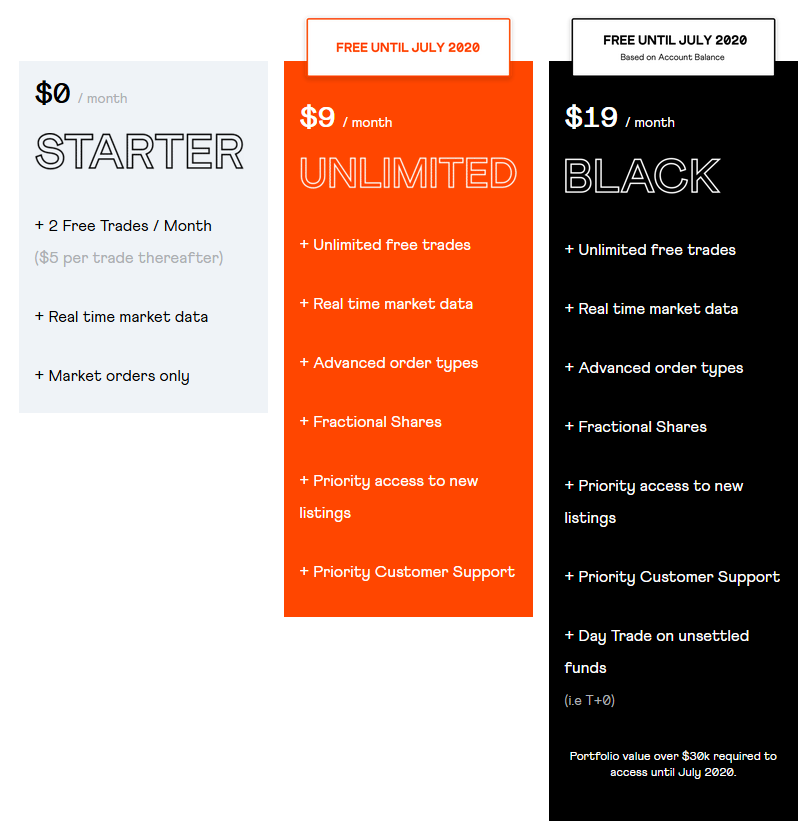

- Free tier remains but limited to 2 trades per month (USD$5/trade thereafter);

- No purchases of fractional shares; and

- At-Market orders only (no limit orders available).

Stake will force maintaining the existing unlimited zero-commission trades and fractional share orders on your account with a USD$9 per month subscription fee. This is being called the ‘Unlimited’ pack, and also gives ‘Priority access to new listings’ and ‘Priority Customer Support’.

An additional ‘Black’ brokerage level was announced, where for USD$19 per month you can take advantage of trading on your unsettled funds. We believe it likely that funds in flight between your AUD and USD accounts will be included in this too.

Customers unhappy as costs increase

The customer outrage on various forums was immediate – the r/AusFinance subreddit was particularly scathing on the changes which on the surface appear to be forcing investors into subscription model pricing, or else suffer a significant reduction in the service on the free level.

The main complaint online centred around the launch of the product without a sustainable business model forcing a change. Other complaints around no additional benefits for early adopters, and the very high cost of additional trades on the starter plan were noted. Two additional trades on Starter Pack will cost more than the monthly fee for Unlimited Pack.

Stake has commented that the changes are needs to maintain a sustainable business model and to roll out improvements to the service faster. The company has been criticised previously for a lack of new features and slow implementation. Poor reporting is another complaint, is sourced directly from their market clearinghouse partner, DriveWealth.

What comes next?

Being the only zero-commission trades brokerage for US Markets within Australia, Stake has pricing power to make changes until competition appears. While Robinhood has stated that they want to come to Australia, nothing has occurred yet other than amassing 90,000 people on a waitlist.

Requests for information from other brokers with zero-commission trades like M1 Finance and WeBull have inevitably come back with non-commital responses. Most of these are similar to ‘We are concentrating on improving our platform and serving the US Market at this time’.

Stake’s new brokerage packs and account restrictions will take effect from July. The company will be rolling out new features and updates almost immediately. The FX margin has not yet changed however Stake has promised that it will be reduced prior to the new fee structure. Maintenance on the platform is already occurring in preparation for updates and new features.

We will be following up this article in the near future with an opinion piece regarding these changes in the Stake business. We will also investigate alternatives for affected investors who wish to move to another broker as a result of these changes.

DISCLOSURE: The author is a customer of Stake and has holdings of NYSE and NASDAQ listed companies within their account at the time of this article being published.